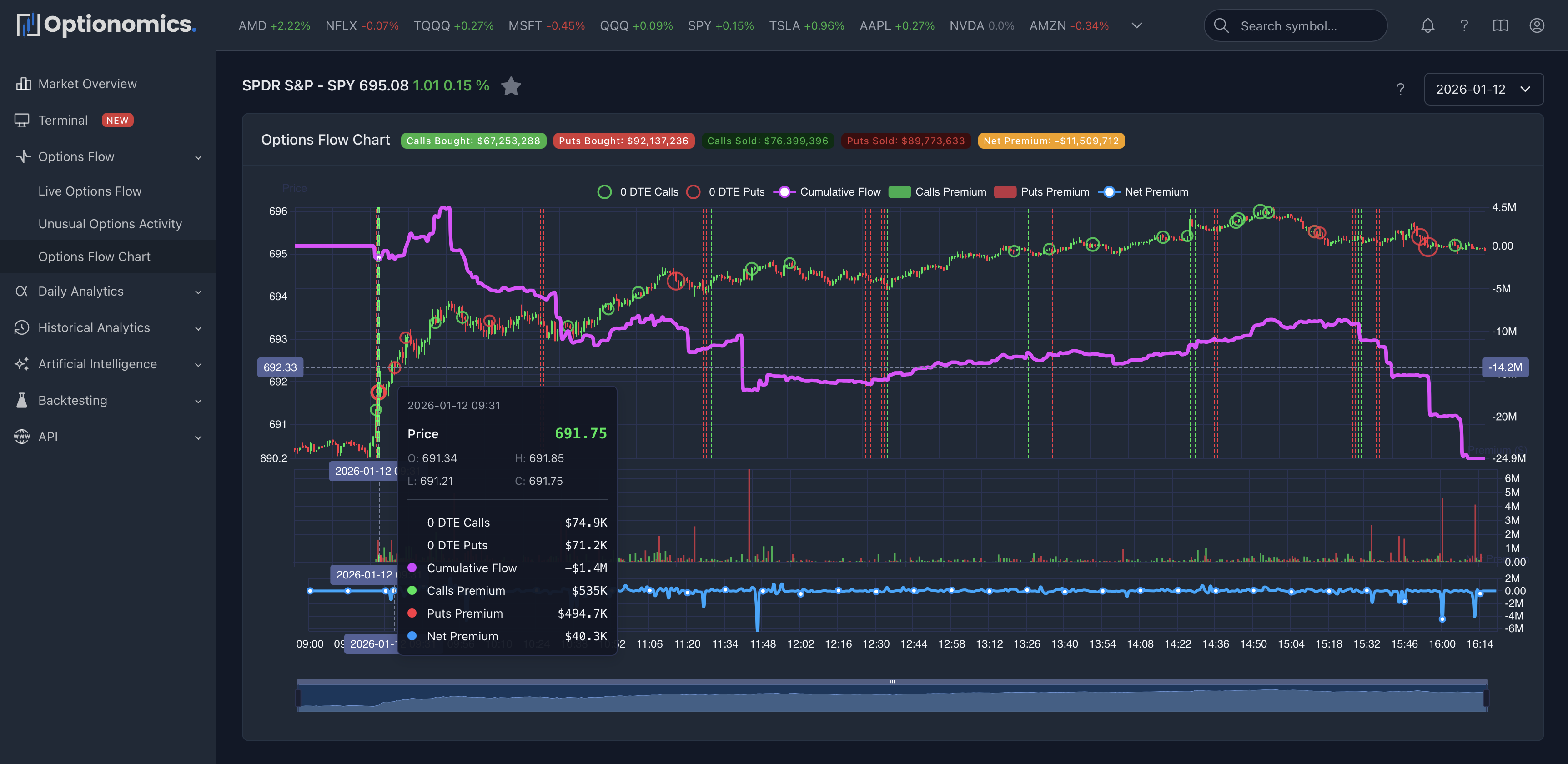

Options Flow Chart

Price action meets options flow

The Options Flow Chart overlays options activity on price, showing you how flow correlates with price movement throughout the day.

Availability: Gamma plan and higher ($59/month+)

Chart Components

The chart combines multiple data layers for comprehensive analysis:

| Layer | What It Shows | Details |

|---|---|---|

| Candlesticks | Intraday price action | 1-minute, 5-minute, or custom intervals |

| Green Bars | Call premium (aggressive buys) | Calls bought at/above ask—bullish flow |

| Red Bars | Put premium (aggressive buys) | Puts bought at/above ask—bearish flow |

| Flow Line | Cumulative net premium | Running total of calls minus puts |

| Bubbles | 0DTE trades | Same-day expiration trades—gamma plays |

| Vertical Lines | Unusual activity alerts | ML-flagged significant trades |

Interactive Features:

- Hover over any bar to see detailed trade breakdown

- Zoom and pan to focus on specific time periods

Premium Summary (Header)

| Metric | Description |

|---|---|

| Calls Bought | Premium on call purchases at/above ask |

| Puts Bought | Premium on put purchases at/above ask |

| Calls Sold | Premium on call sales at/below bid |

| Puts Sold | Premium on put sales at/below bid |

| Net Premium | Calls minus puts |

Reading the Flow Line

The cumulative flow line shows net positioning throughout the day:

| Pattern | Interpretation |

|---|---|

| Rising line | Net call buying (bullish flow) |

| Falling line | Net put buying (bearish flow) |

| Sharp spike | Large trade or cluster |

| Flat line | Balanced or quiet period |

0DTE Bubbles

Same-day expiration trades appear as bubbles:

- Size = Premium spent

- Green = Calls

- Red = Puts

0DTE activity often signals event-driven bets or gamma plays.

Flow + Price Patterns

Understanding the relationship between flow and price movement:

| Pattern | What It May Suggest | Confidence Level |

|---|---|---|

| Call flow spike → price rise | Flow preceded the move—smart money positioned early | High |

| Price up + put flow rising | Hedging into strength—taking profits or protecting gains | Medium |

| Flow divergence from price | Potential reversal setup—flow not confirming price | Medium |

| Heavy flow at support/resistance | Conviction at key level—institutions defending/attacking | High |

| Price rises, flow flat | Weak move—lack of options conviction | Low |

| Massive flow, price unchanged | Hedging or spread activity—not directional | Low |

| Flow and price aligned | Strong trend—both confirming direction | Very High |

| 0DTE spike at level | Gamma positioning at strike—potential pin | Medium |

Remember: Flow shows correlation, not causation. Large trades can be hedges or wrong.